P2P Lending Platform

- What It Is

- How It Works

- Benefits and the Future

\”The progressive technologies and the sharing economy have opened up the doorway for a life-changing function – Alternate Financing. It has two different financial methods: Crowdfunding and P2P Lending.\”

What is Peer-to-Peer or P2P Lending?

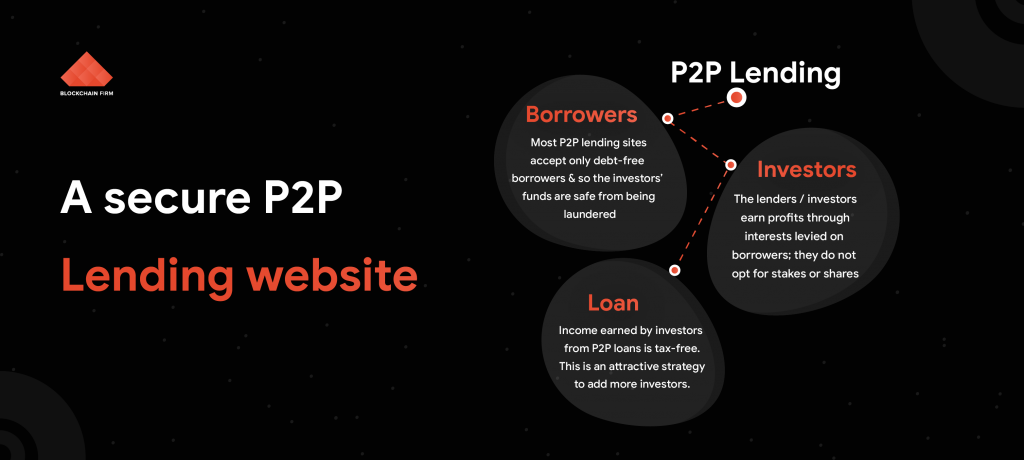

P2P lending is a method through which lenders lend money to borrowers at a regular interest rate. The entire process is done on a P2P lending platform. P2P is one of the best investment options available in the market. It benefits the investor/lender with higher returns on the capital.

The sudden rise of P2P lending has paved the way for many individuals and businesses to lend money to borrowers hassle-free, therefore, eliminating the involvement of banks or any other intermediaries.

What Led to the Invention of Peer-to-Peer Lending?

Post the Global Financial Crisis, almost all banks began losing their monopoly in the financial market. The primary reason for this loss was a drastic fall in customer trust. And the second reason was even worse \’limitations levied on credit financing.\’

After this dramatic fallout, people around the world started looking for an innovative and safe alternative mode of financing. This led to the development of P2P lending, which grew in strength in a short duration. In P2P lending, individuals lend money instead of investing it.

\”P2P Lending seems to favor investors compared to borrowers since it comes with far fewer risks than Equity Investing.\”

\”Similar to a crowdfunding model, there are three parties involved in P2P lending: Lending Platform, Lenders, and Borrowers.\”

How P2B Loans differ from P2P Loans?

P2B loans enable any individual to finance businesses. When an enterprise applies for a mortgage on a lending platform, they provide necessary information about their projects, such as the purpose of raising capital, financial-related statements, and funding strategies. The individual who wishes to give a loan can review the business portfolio and select the project they find interesting.

Is P2P Lending the Right Solution for You?

- Unfortunately, banks levy huge annual interest rates on loans. P2P loans, on the other hand, do not make borrowers spend much on fundraising.

- P2P lending is a web service that means the application process occurs in a blink of an eye, therefore, making you forget the tedious paper-based process and long queues.

- P2P lending does not charge penalties if the borrowers want to pay a loan in advance.

- Unlike bank-based loans, there is also no requirement of any collaterals or such things.

- With its transparent nature, P2P platforms aid businesses to view how much progress has been made and who has contributed to a project.

Why Choose P2P Lending Over Bank-based Lending

Getting a loan from a bank is a tedious process. Each of us is aware of the traditional lengthy process involved in the loan procedure. Whenever a person approaches the bank for a loan, the bank starts asking for multiple documents, checks the credit score of the person, analyses his previous transactions, and sometimes they even ask for collateral.

\”Even when the individual submits all the documents on time, the bank takes nearly a couple weeks to process the application.\”

To avoid the long-standing queues and say goodbye to the traditional procedure, P2P lending is the best alternative. With P2P lending, borrowers are connected directly with the investors. The lenders then select the loans requested by the borrowers. The type of loan varies from personal loans to business loans to home loans.

Benefits of Borrowing on a P2P Lending Platform

1. No Additional Charges for Loan Prepayment

- Usually, when you close a loan taken from a bank early, the bank levies a Pre-closure fee, which is somewhere between 2-4%

- Whereas, it is not the same with P2P loans. P2P lending platforms do not levy any charges when an applicant Pre-closes the loan.

2. Flexibility

- P2P loans are more flexible when compared to bank-based loans. If the lender wishes, he/she can process a loan despite the risks involved while it is not the case with bank loans

3. Paperless Procedure

- P2P loans are usually processed digitally. Only a few lending platforms involve a physical verification at the customer address.

- If you visit a bank, you have to submit all the documents physically, and some banks ask you to send both physically and digitally.

Benefits of Investing on a P2P Lending Platform

1. No Intermediaries Involved

In P2P lending, the interest rates and the loan amount are decided by the investor and the borrower without anyone interfering.

2. Platform Stability

P2P platforms are safer options, and they come with reduced risks when compared to the risks involved in bank-based lending.

3. Passive Income Source

By lending money to borrowers through a P2P platform, you start generating passive income through the interest levied on the loans.

\”In a conventional lending process, people require intermediaries such as loan officials, banks, and loan processors to build trust. Also, the involvement of intermediaries in the loan process leads to high fees.\”

How does a Blockchain-Powered P2P Lending Platform work?

Lender Creates an Account

- The lender creates a profile with his/her necessary details such as Name, ID, Contact Info, Bank Details, the investment type through which the lender wishes to lend funds, interest rates, and the tenure.

- After filling in the necessary credentials, the lender submits the completed application to the platform.

Loan Requests

- Before proceeding with further action, the lenders will have to wait until they receive any loan requests from borrowers.

- When a borrower initiates a loan request on the platform, the lender schedules a verification process for the borrower.

Borrower Creates an Account

- Similar to the lender\’s account creation process, the borrower creates a profile with all the necessary information.

- In addition to the basic details, the borrower has to provide collateral like digital assets and legal documents.

Initiating a Loan request

- Upon successful completion of profile creation, the borrower can request a loan from lenders on the P2P platform.

- Smart Contracts regulate this loan process by acting as a communication medium between the borrowers and lenders.

Communication between the Lender and the Borrower

- The lender, once he receives a loan request from the borrower, he will schedule an interview with the borrower

- This interview is a part of the lending process, and post this session, the lender either approves or rejects the loan.

- The interview usually comprises the following questions:

- What is the purpose of the loan?

- What is the borrower\’s monthly income?

- What is the tenure of the loan repayment?

- How many times have you availed a loan previously?

Smart Contracts fix the ROI (Rate Of Interest)

- When the lender approves the loan request, Smart Contracts play a significant role in processing the loan.

- They categorize the borrowers based on their creditworthiness and decide interest rates according to the category.

- The borrowers are classified as low-risk, medium-risk, and high-risk borrowers based on their repayment rates.

Lender Credits Borrower with the Loan

- Post the successful completion of the interview process, and if both the parties agree on the Terms & Conditions, the lender sends the loan amount to the borrower.

- The lender transfers the money to the borrower from their wallet. The borrower is now liable to repay the loan within the stipulated time (loan repayment tenure)

Auto-Repayments through Smart contracts

- When it\’s time to repay the first installment or EMI, the borrower initiates repayment through Smart Contracts, integrated with the wallet.

- If the borrower fails to repay any EMIs on time, these Smart Contracts will automatically add late payment fees to the original loan amount.

\”The borrowers are advised to repay the loans on time to avoid penalties and instant loan approvals in the future.\”

P2P Lending Vs. The Stock Market?

The choice of investment you prefer ultimately depends on how the investor lying inside you think.

If you are willing to

- Invest your valuable time and energy

- A lump sum of money into your portfolio

- And of course, if you can calculate the trends in the share market

Then the Stock Market is the best choice for you. Once you invest in the market, you will get higher returns within a week, or it can take a month or two.

On the contrary, if you don\’t have adequate knowledge of the stock market, then Peer-to-Peer lending is the best option for you.

The Future of P2P Lending

The entire world witnessed the sudden rise of P2P lending from a market niche to a significant player in the financial industry. Individuals and businesses always look for a faster and hassle-free way to borrow money. P2P lending is one such way. These platforms are more flexible and efficient than the banks; therefore, they attract a more massive crowd of borrowers and lenders. Within five to ten years, P2P-based loans will replace the traditional loan procedure.